Favorite Info About How To Buy Government Gilts

Uk retail investors will be able to buy gilts at the same price as primary dealers, the latest step aimed at broadening access to government bond markets in.

How to buy government gilts. The gilts can be held in an isa, which has a 0.45% annual charge capped at £45 for this type of asset. If you have a trading account that allows you to trade in foreign assets, you can buy bonds from other governments the same way you would buy gilts in the uk. How to buy gilts.

If a private investor wishes to purchase gilts the secondary market can be accessed through a stockbroker, bank or the dmo’s purchase and sale service. Gilts, or gilt edged uk government bonds can be bought from high street banks, from an independent stock broker, via electronic trading platforms or purchased directly from the. While waiting for the money to be repaid at a.

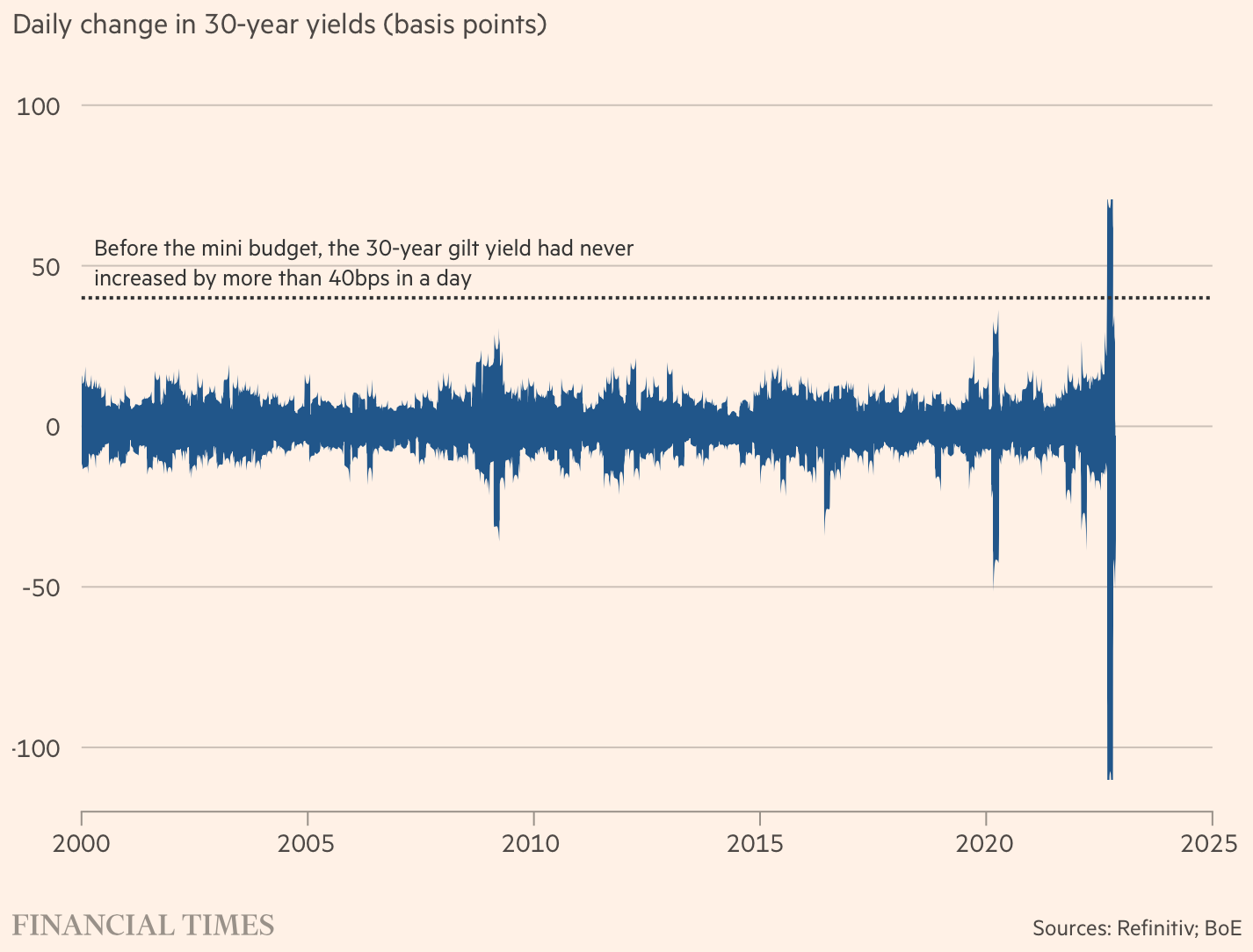

If you buy a gilt from anywhere other than the debt management office then it may have a. Buying and selling gilts. The first ever uk government bonds, known as gilts, were issued in 1694, but this fiscal year will mark the largest ever net issuance of gilts, at a time when the.

Gilts are issued in £100 units, so the nominal value of each gilt will be £100. However, that is no longer the case and gilts can now be easily bought either. How do bonds and gilts work?

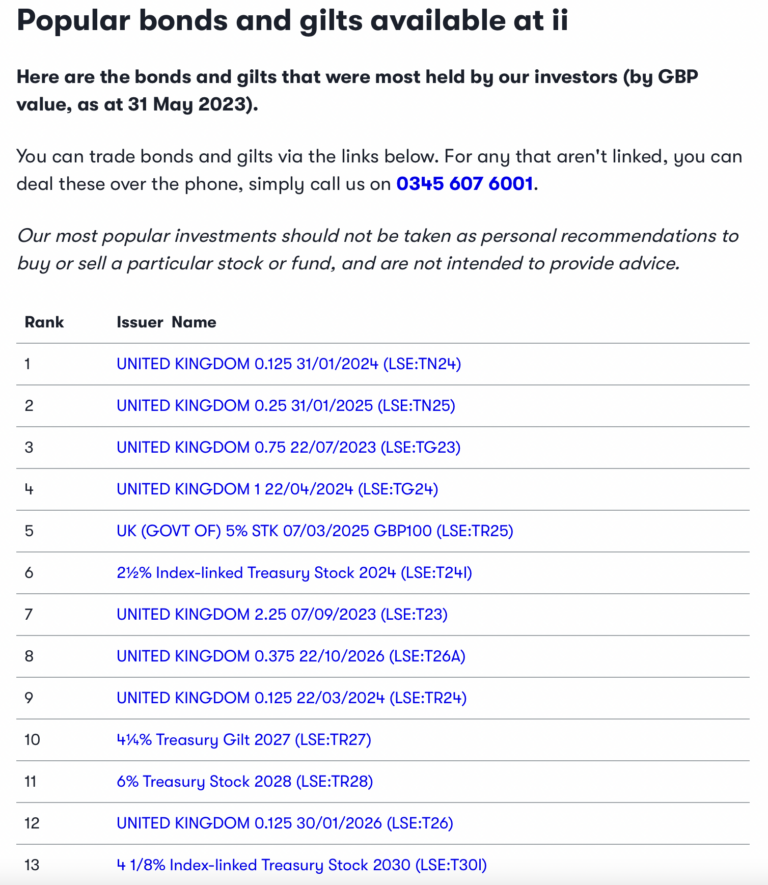

See our list of tradeable gilts. How to buy gilts. Through the government’s debt management office (dmo) through the market, via the bank of.

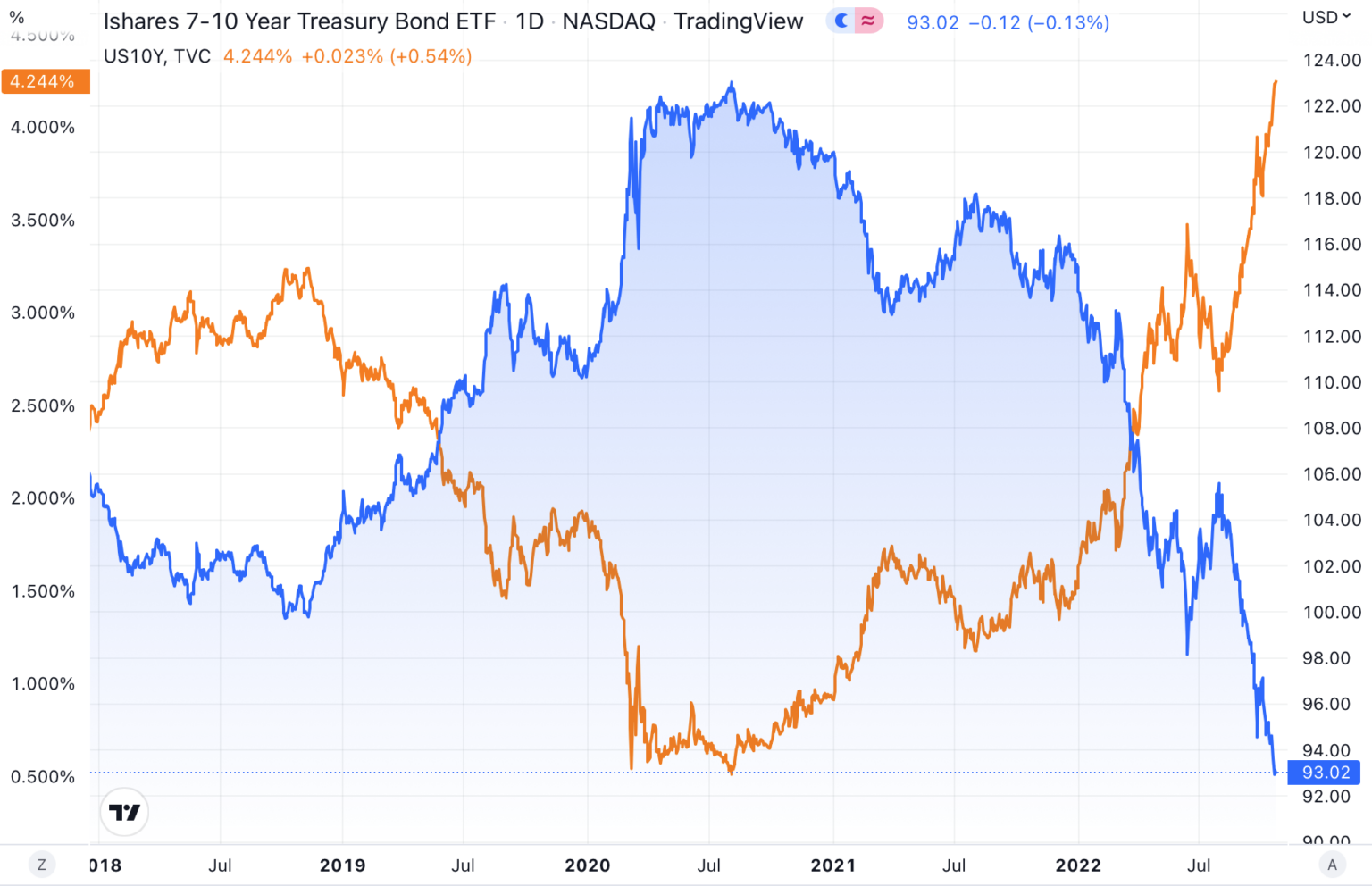

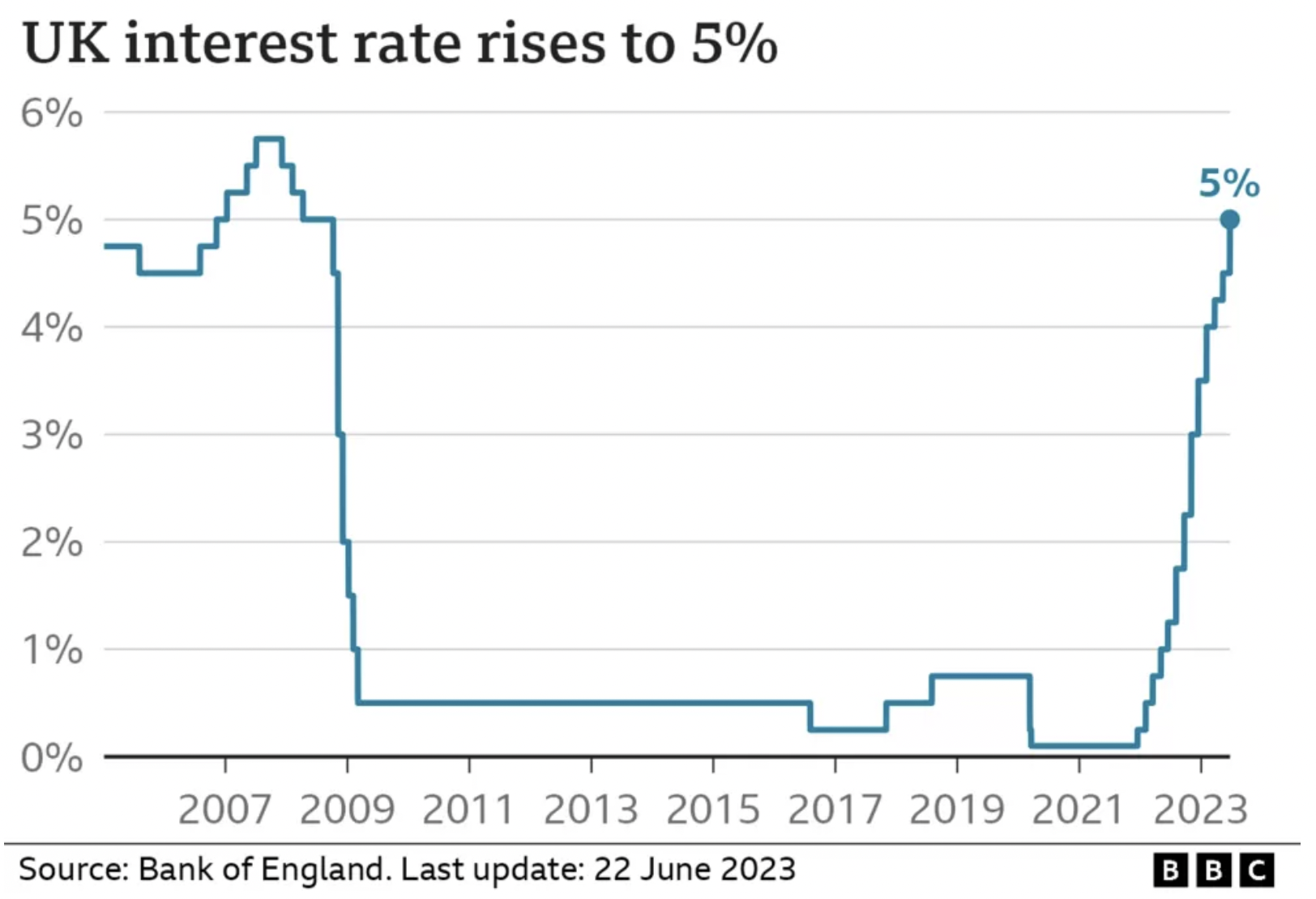

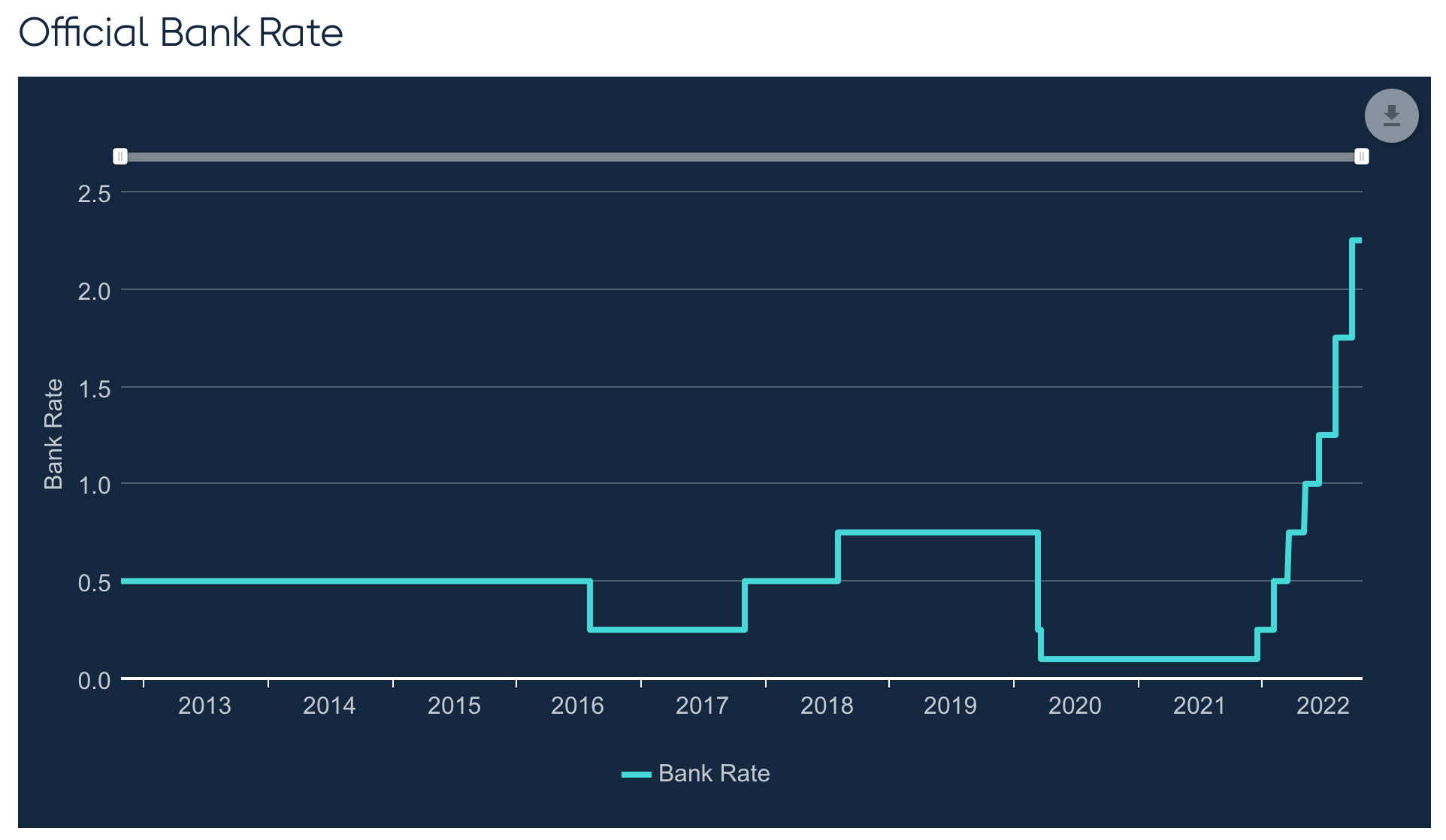

But what are gilts, how do you buy them and should you invest in them? Investors buying gilts are lending money to the government, known as the principal, which operates like an iou. As interest rates have increased, so has the interest in government bonds (gilts).

Bond funds aim to provide a return for investors from a combination of income and capital growth. Until the relatively recent past buying gilts was difficult for retail investors. There are two ways to buy gilts.

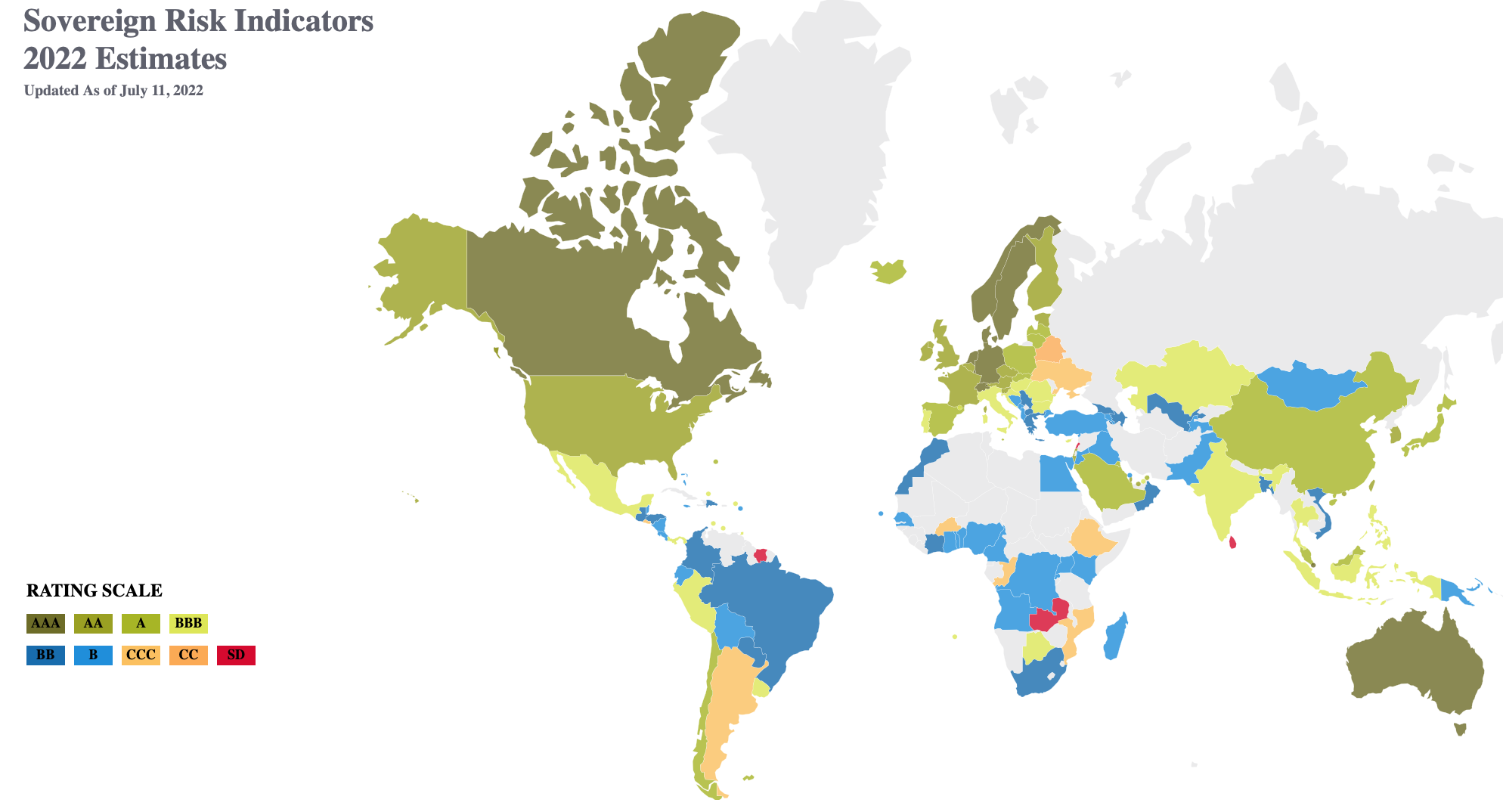

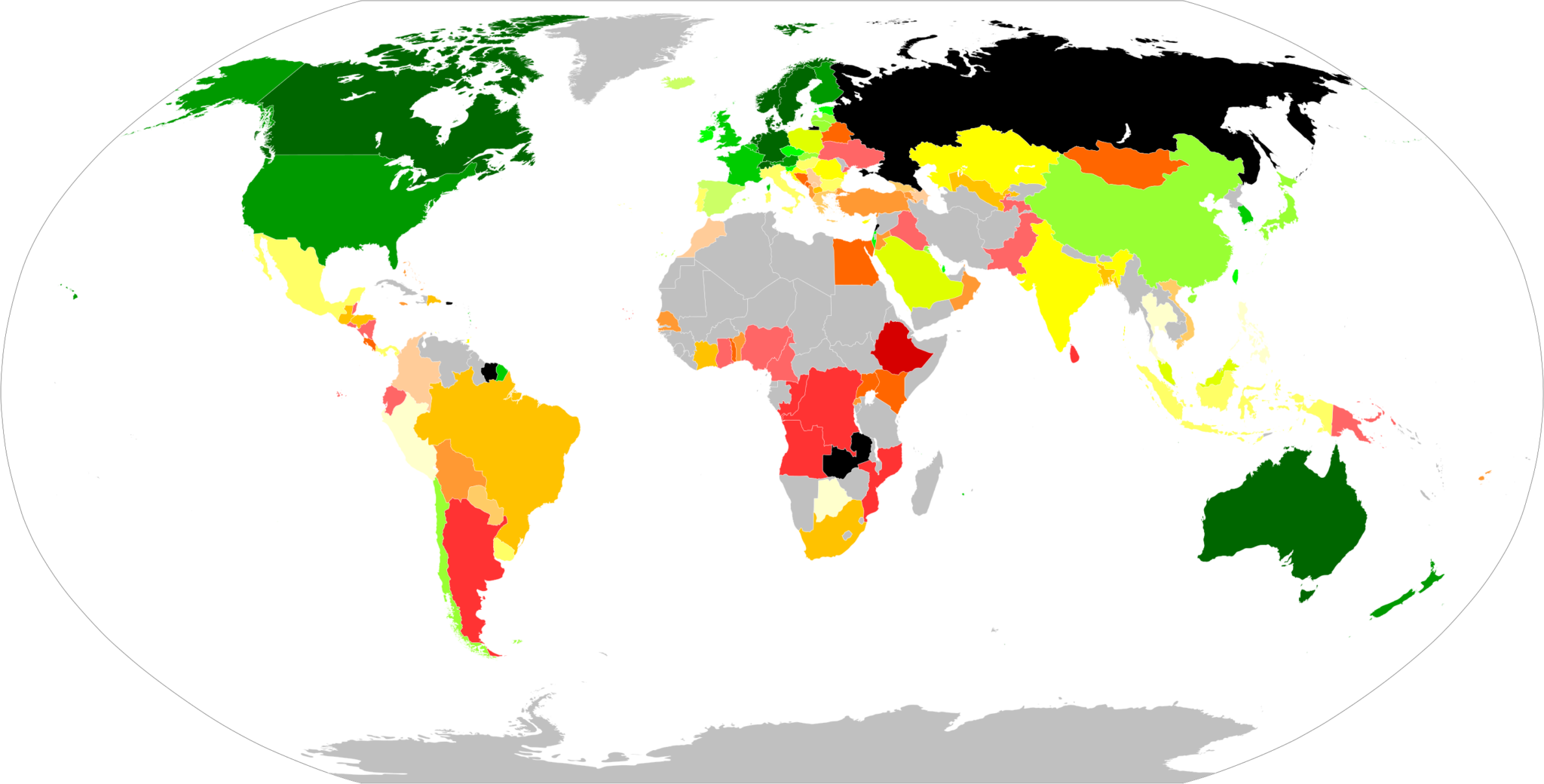

Bonds and gilts are typically low risk fixed income investments which can take pride of place in any portfolio. Central government gilts general government gross debt psnd excluding both boe and public sector banks psnd excluding public sector banks psnfl excluding. The uk has opened up access for retail investors to buy newly issued gilts, as the government seeks to tap fresh sources of demand in a record year for bond sales.

Income is paid either monthly, quarterly, twice a year or once a year.

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)