Perfect Tips About How To Buy Consumer Debt

Provide at least the name and address of.

How to buy consumer debt. Create a list of all your debts. These are open ended accounts with written agreements ageing of. What to know about capital one’s proposed acquisition of discover.

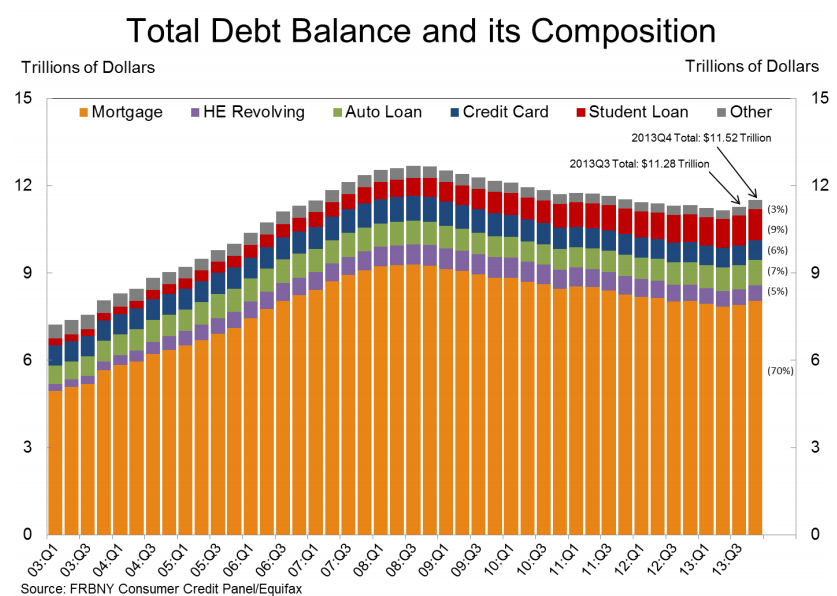

Add up your debts: The debt buyer paid very little for your old debt, most likely a few cents on the dollar. This includes credit cards, student loans, medical loans, personal loans, home equity loans, and helocs, etc.

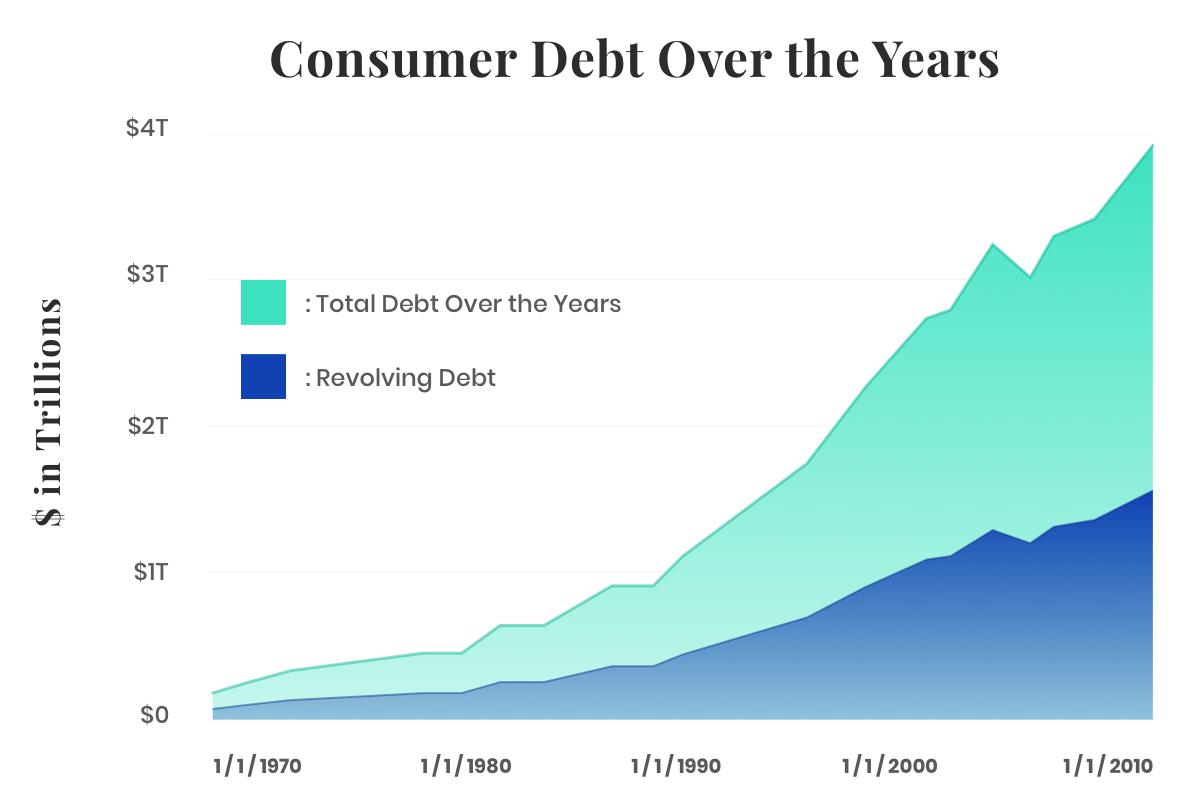

Debt is used by many corporations and individuals as a method of making large purchases that. Before two of the largest credit card companies in the united states can complete a $35 billion. December 13, 2022 fact checked read time:

You can start with as little as $1,000 and buy anywhere from $10,000 to. If you have credit cards or loans, you probably have consumer debt. February 15, 2024.

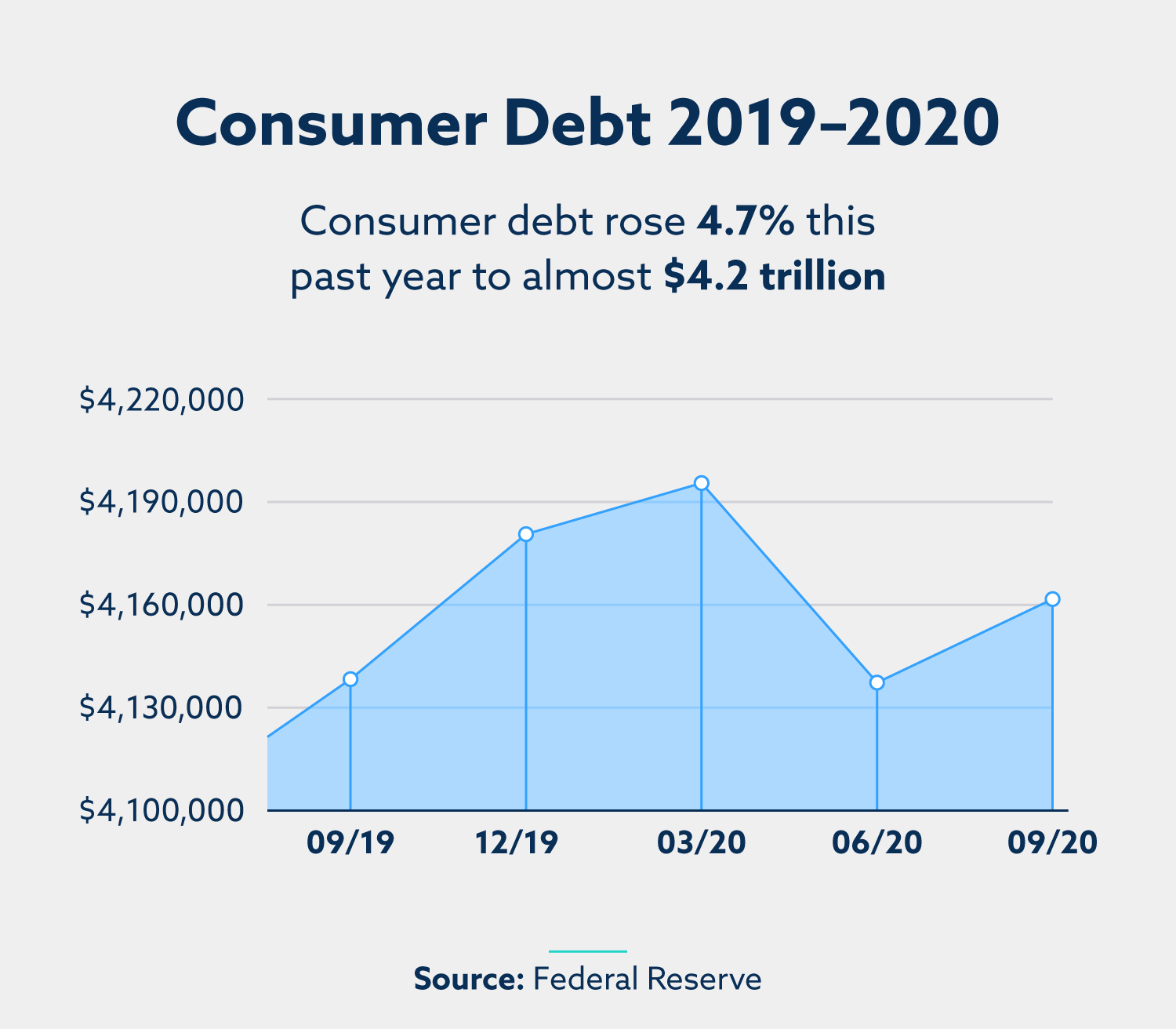

On our loan marketplace they buy and sell all sorts of debt portfolios: The economic data shows that americans are getting deeper into debt, and they’re having a harder time keeping up. To successfully deal with a debt buyer, you need to be aware that:

Determine the type of portfolio that fits your needs research potential sellers contact them with a proposal negotiate the terms tips for. Read more consumer debt refers to any money you borrow for personal, family, or household purposes. Key takeaways consumer debt consists of those loans used for personal consumption as opposed to debts incurred by businesses or through government.

3 min what's next about sell payday loans at the highest price consumer debt for sale sell credit card debt table. Consumer debt refers to personal indebtedness incurred due to the purchase of items for personal or family use. A 5 point guide you should be aware of.

There are four key steps involved: Baby steps for purchasing.

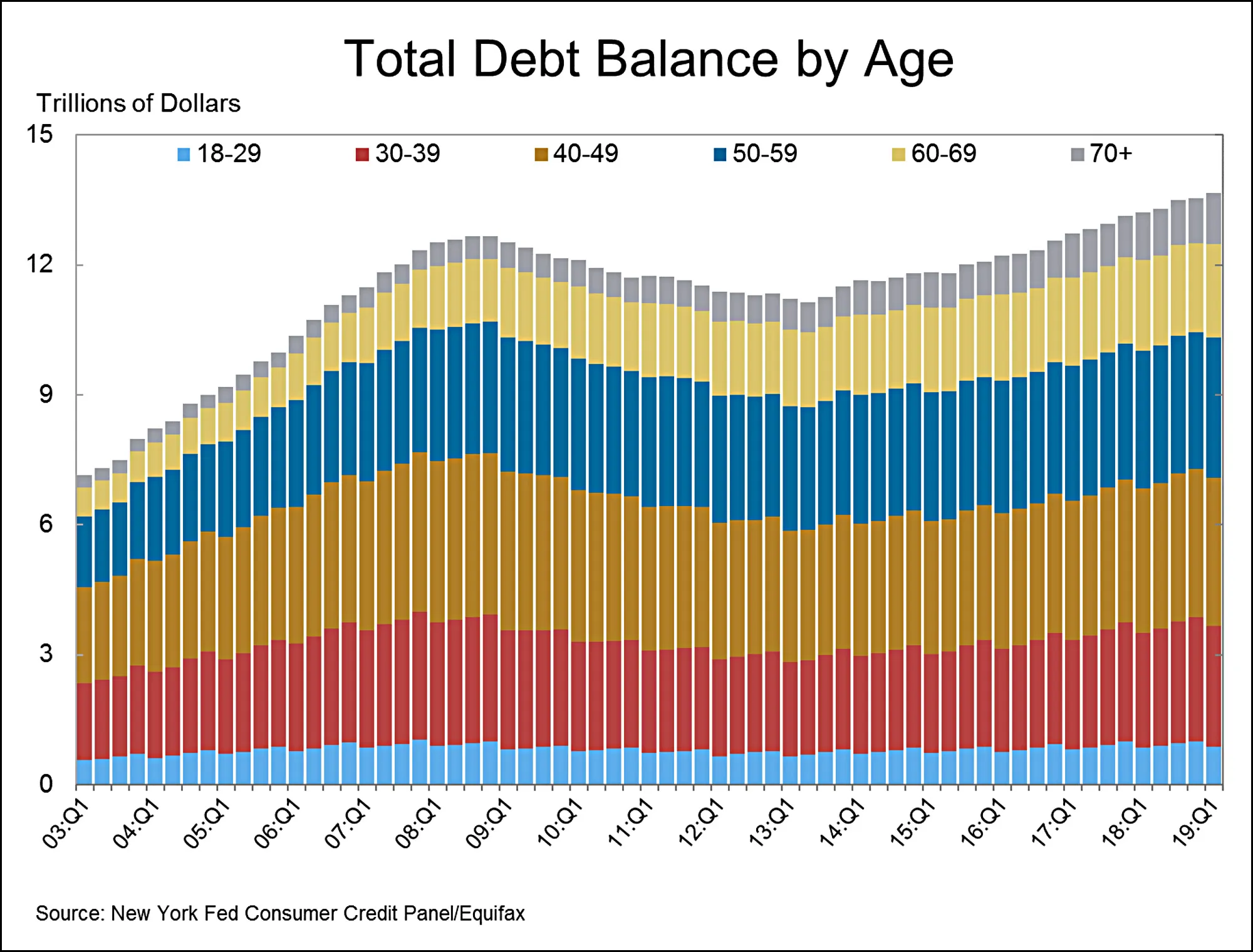

Debt is an amount of money borrowed by one party from another. Real estate notes, auto notes, payday portfolios, installment portfolios, medical debt,. In the fourth quarter of 2023, americans held $1.13 trillion on their credit cards, and aggregate household debt balances increased by $212 billion, up 1.2%, according.

Identify themselves as a debt collector and notify the consumer that any information given will be used toward the collection of the debt. Justin cupler contributing writer at. Consumer bank capital one plans to acquire u.s.