Awesome Info About How To Buy Bonds In Singapore

The bonds are available for purchase through participating banks in singapore, such as dbs/posb, ocbc, and uob, making them accessible to most.

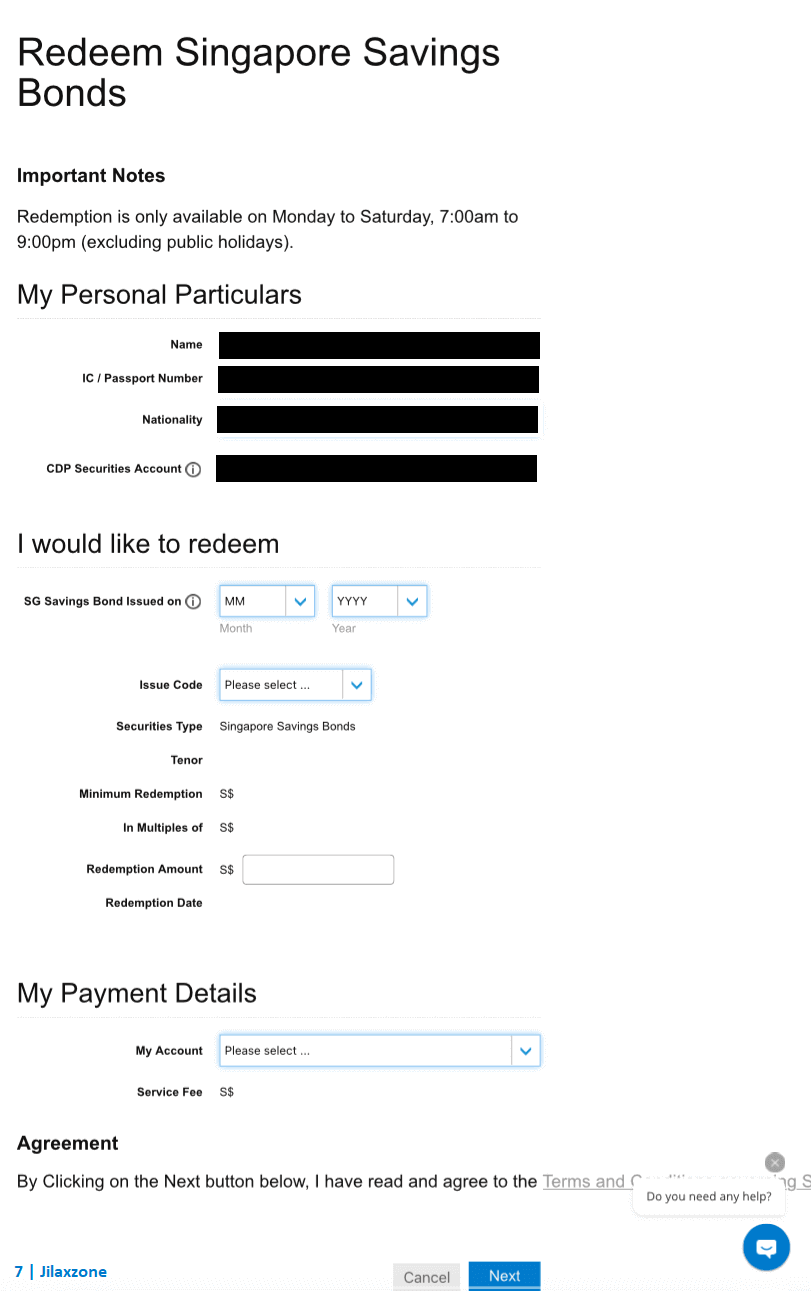

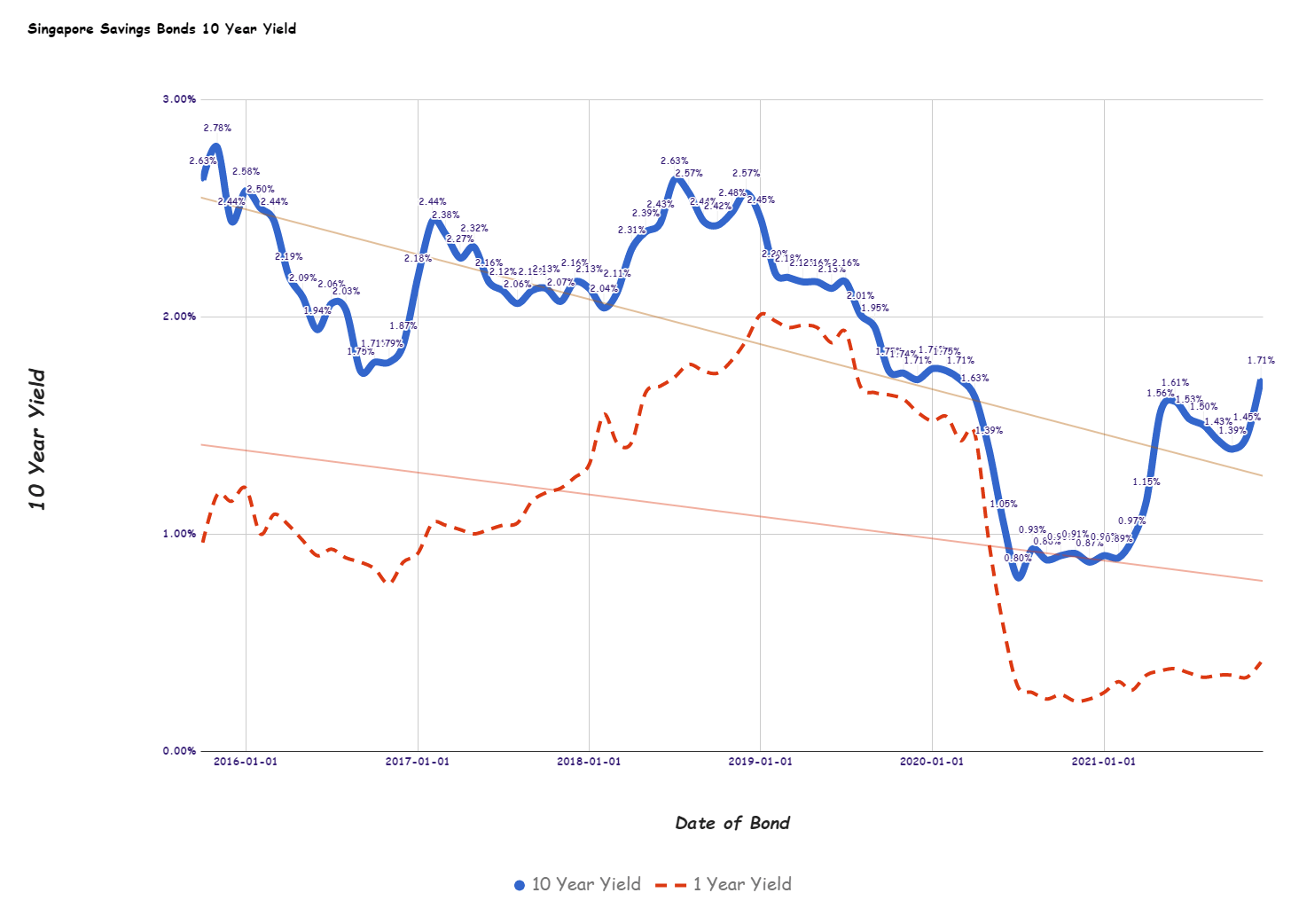

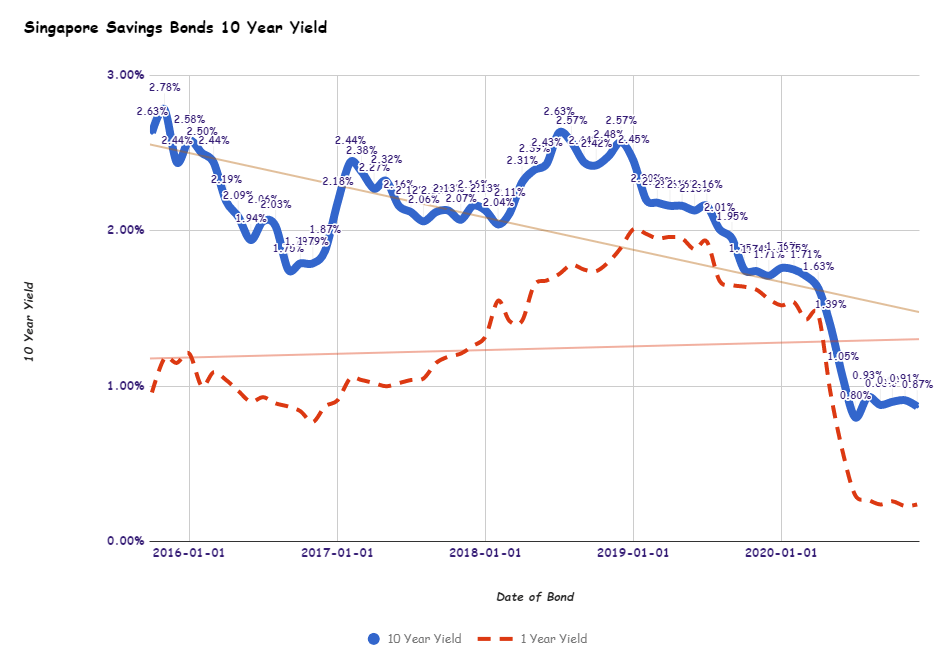

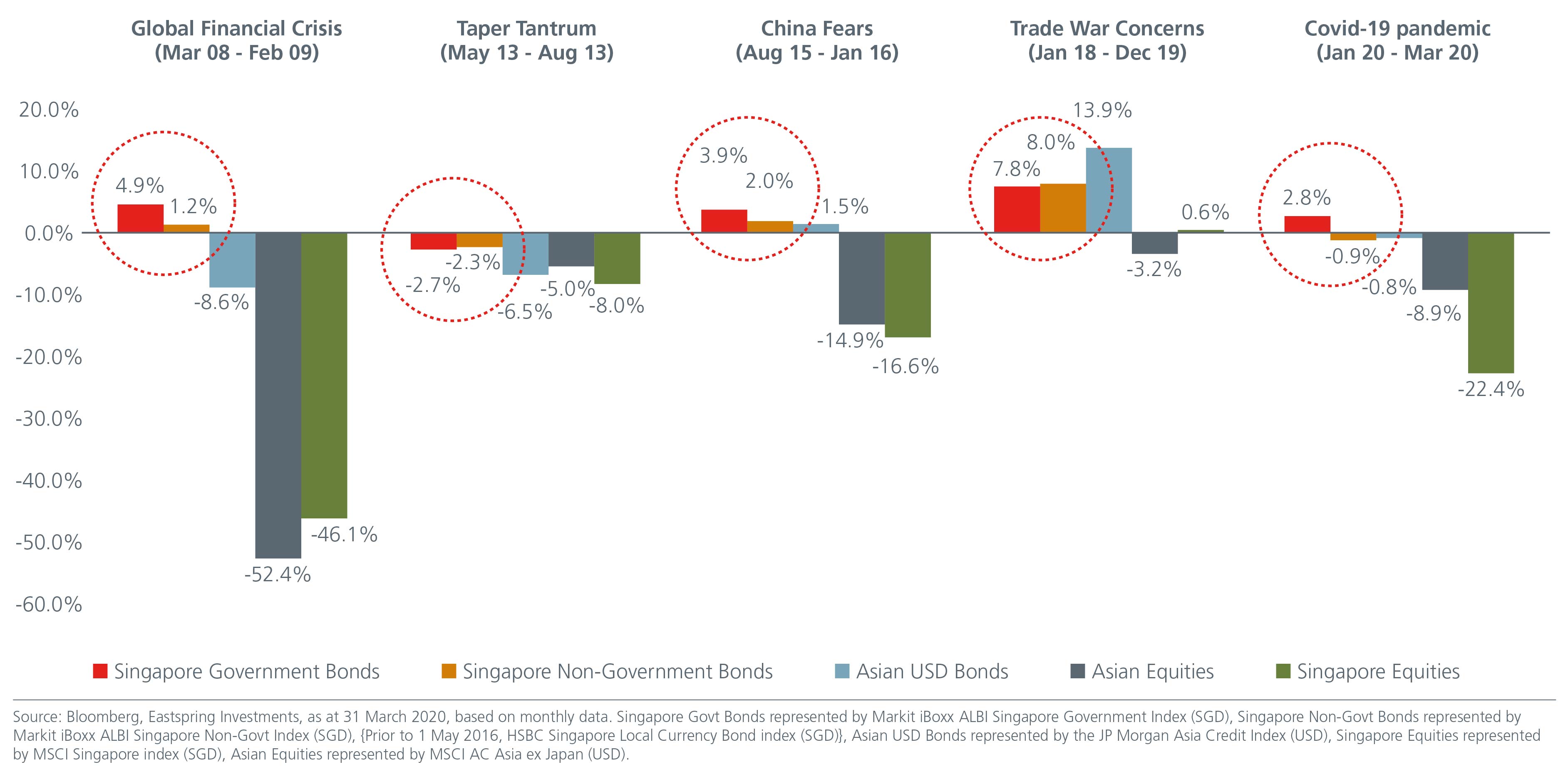

How to buy bonds in singapore. When we invest in corporate bonds, we are lending money to a company in return for interest payment, as well as to return our principal when the bond matures. Singapore savings bonds (ssb) the announcement date for singapore savings bonds sboct23 (gx23100t) and the opening date of the redemption of ssbs in september. Higher interest potential than cash savings accounts diversify your investment risk.

Dbs offers comprehensive fixed income investment opportunities when it comes to investing in bonds in singapore. Trade on sgx (sgs bonds only) if your sgs bonds are held in your cdp or srs account, you can trade. Consider various ways to earn money from corporate bonds in singapore.

Singa bonds, or sgs bonds, are investment bonds issued by the singapore government on 28 september 2021. The most common avenue to purchase bonds. And international business machines corp.

A potential tax benefit is spurring us companies including pepsico inc. Subscribe are singapore savings bonds safe? A potential tax benefit is spurring us companies including pepsico inc.

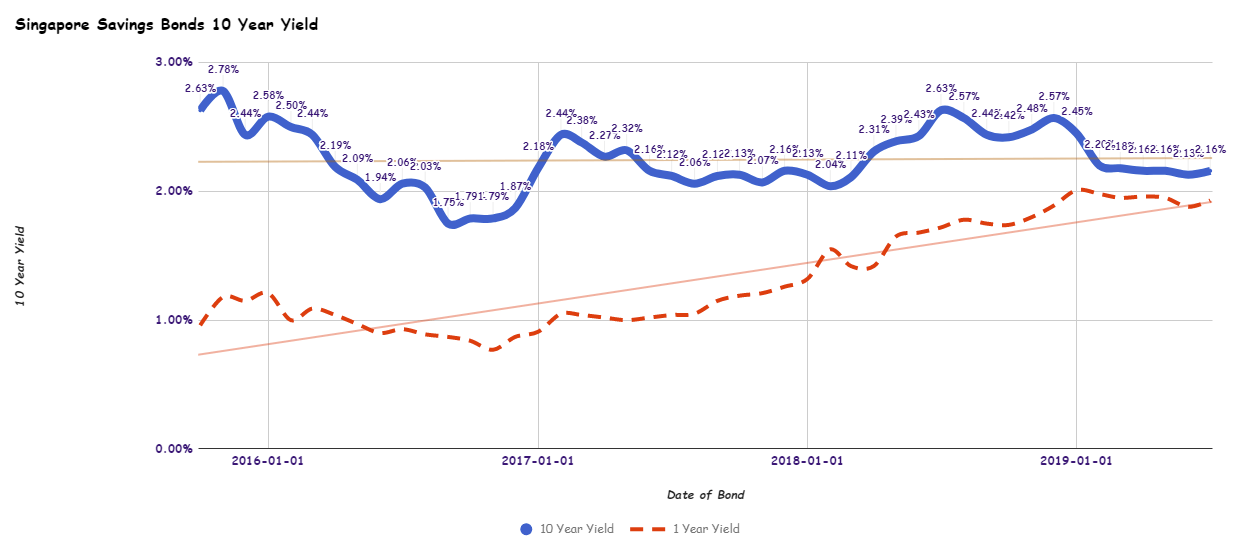

Singapore savings bond is a popular investment option for individuals seeking a safe and steady return on their savings. Discover how corporate bonds work and how you can take a position. Investing in bonds in singapore is a process that is accessible to most investors, whether seasoned or novices.

Decide how much you want to invest in s$1,000 increments. There are two main ways investors can earn from investing. Ssb is arguably one of the safest products on the market.

That mainly came from pfizer’s. An individual cdp securities account with. The singapore government’s “aaa” credit rating and.

How to invest open an investment account benefits bonds offer several key benefits: A bank account with dbs/posb, ocbc and uob. As mentioned, the most basic way to earn money from corporate bonds is by waiting for the.

Open a bank account online or visit any of the banks' branches in singapore to open an account. When an investor buys a bond, they are lending their money to the issuer for the stipulated period of time. Deals can lower borrowing costs, if authorities allow them.

To sell bonds through their singapore. The purpose of launching these bonds.

/https://specials-images.forbesimg.com/imageserve/5f26f2c372f16e8fc10ec4ec/0x0.jpg)

.png)